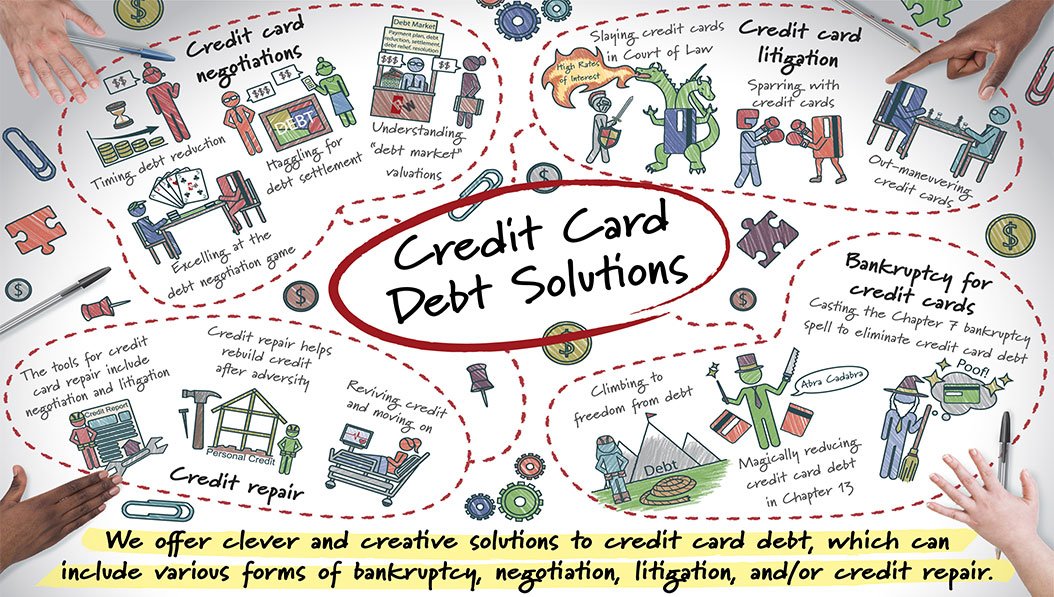

Can I Hire a Credit Card Debt Lawyer?

Depending on the type of credit card debt that you owe, you may be able to use a credit card debt lawyer to help you negotiate a settlement or even file a countersuit against the credit card company that you owe.

Can a credit card company sue you?

Whether or not you can be sued by a credit card company depends on your account balance, previous defaults and other factors. The chances of being sued increase with recent defaults.

If your account balance is low, then you may be able to get a settlement with your creditor. You can also hire a debt collection attorney to negotiate a payment plan with your creditor. Alternatively, you can file a bankruptcy. But before you do anything, you should understand what your rights are when it comes to credit card debt.

Your credit card company may try to contact you several times before filing a lawsuit. They may even transfer the debt to a collection agency. These agencies have more experience and are more aggressive in trying to collect on a debt. You will also have a negative impact on your credit score if you hire a debt collection agency.

Generally, a credit card company will wait six months before filing a lawsuit. However, if the balance on your account is high enough, they may file a lawsuit sooner.

If you are sued, you will have 21-30 days from the date of the lawsuit to respond. You will receive a summons with details of the lawsuit, including a court date. You should respond to the summons as soon as possible. If you fail to respond, you may lose the lawsuit and your creditor may win by default.

If you have been sued by a credit card company, you should speak to an attorney before you respond to the lawsuit. An attorney can help you negotiate a payment plan, negotiate with the creditor and ensure that you do not violate any of your credit card rights.

Can a credit card debt lawyer file a countersuit?

Whether or not you can file a countersuit against a credit card company depends on a number of factors. First, you must have a valid claim. You must prove that you are the owner of the debt or that you have the right to bring the lawsuit. In order to prove your claim, you will have to provide documentation of the “chain of custody” connecting the debt to you.

In addition to the chain of custody, you must also provide proof of the debt amount and fees. You may also be required to provide a copy of the original credit agreement that you signed. If you do not have the original contract, you may not be able to recover interest charges.

You may also be able to use the Fair Debt Collection Practices Act to stop the collection agency from harassing you. However, this is a fairly complex state-law defense, and may not be suitable for your particular situation.

Regardless of whether or not you can file a countersuit, you should study the complaint carefully for accuracy. If the plaintiff’s claims are not valid, you should raise any defenses you may have.

A counterclaim is a claim made by a person who is being sued against the person who initiated the lawsuit. It can be a new claim or a claim that is related to the other side’s claims.

You will need to check your local rules to determine how long you have to respond to the lawsuit. This is called the “statute of limitations” and varies from state to state. In general, most statutes of limitations are 4 to 6 years.

If you want to file a countersuit, it may be in your best interest to consider hiring a lawyer. Not only can an attorney help you respond to the lawsuit, but he or she will be able to keep you informed about the case’s progress.

Can a credit card debt lawyer garnish wages or put liens on your house or bank accounts?

Whether you need to hire a credit card debt lawyer or not depends on the amount of debt you owe. If you are behind on credit card payments, you can take steps to avoid a garnishment.

A garnishment is a legal document that requires an employer to withhold money from an employee’s paycheck. The amount of money that is withheld varies by state. The amount can also include fees or costs associated with the debt.

A judgment is a legal document issued by a court that outlines the amount of money you owe and specifies a certain amount of garnishment. Most creditors will not force you to sell your house. However, you might be evicted or have your service shut off.

You might also have to pay taxes on the money that is taken. There are laws that protect you from creditors, bill collectors, and other people trying to collect money from you. If you are unable to pay off your debt, you should consult with a credit counselor to find out what options are available to you. Generally, credit counselors are non-profit organizations that offer educational materials to help you get your finances in order.

A garnishment is an order issued by a government agency. In some states, the process is called a levy. Generally, the law requires that a creditor provide the debtor with advanced notice. If you receive a notice, you should contact your lawyer immediately. Generally, the law allows the debtor to avoid a garnishment by settling the debt in full.

You can also try to settle your debt before being sued. Some states have laws that allow a creditor to file a lawsuit and take money from your wages. However, this can be difficult to defend. If you are sued, you need to make sure you understand the statute of limitations and use it as a defense.

Can a credit card debt lawyer call/text/email you?

Whether you are a victim of debt fraud or simply owed money on your credit cards, you may be wondering if a credit card debt lawyer can call, text or email you. The truth is, a credit card debt lawyer can call, email or text you, but there are some things you should know about how to avoid getting harassed.

The Federal Fair Debt Collection Practices Act (FDCPA) is a federal law that prevents debt collectors from using unfair or abusive practices when they attempt to collect a debt. The law applies to all forms of communication, including telephone calls, emails, text messages, and even social media.

A debt collector may not threaten you with arrest or legal action. They may also not disclose information about your debt to third parties, and they must provide you with an opt-out option. They also cannot use abusive language, and they cannot call you more than twice a week.

If a debt collector calls or texts you, ask for their name, address, and telephone number. Be careful about giving them your credit card number. Some companies are fraudsters, so you need to make sure the person you are talking to is legitimate. You may also request a callback number.

Debt collectors cannot call you more than twice a week, and they cannot call you during off-hours. The law also says that collectors can only contact you by phone between eight am and nine pm in your time zone.

Credit card creditors may also try to find you by calling people you know. You may not pick up a landline, so you should let the debt collector know if they call at different times than you normally do.

Can a credit card debt lawyer negotiate a settlement?

Depending on your situation and debt level, it may make sense to hire a debt settlement attorney to negotiate a settlement with your credit card company. An attorney can help you lower your debt, consolidate your bills, or put your debt on a payment plan.

A lawyer’s fee can vary depending on the debt, your location, and the amount of work involved. An attorney may charge an hourly rate, or a flat fee to handle the negotiations. The amount of time needed for a negotiation can vary, too.

A debt settlement attorney will likely be more familiar with the laws and nuances of the debt settlement process than you are. They can advocate for your consumer rights, and protect you from shady practices and scams. A lawyer can also be your ally when it comes to protecting your credit report.

You may be able to negotiate a settlement with your credit card issuer within a few months of your last payment. Some creditors may even be willing to settle your debt for an amount that is substantially lower than what you owe.

However, it’s important to remember that a settlement may not be the right choice for you. Credit card issuers are not equipped to handle prolonged collections, and they may drop you or turn over the debt to a collections agency.

Whether you hire a debt settlement attorney or negotiate with your credit card company on your own, you’ll need to know what you’re doing. This can help you get the most out of the process, and maximize your chances of achieving your goal.

A good settlement law firm will know how to negotiate a settlement and which practices are in compliance with the Fair Debt Collection Practices Act. You can also get advice on how to design a budget.